- The German NewSpace sector has been steadily growing over the past two decades

- There is reason to believe that this growth will accelerate in the 20s

- The industry is mainly located around Berlin, Bremen, Darmstadt, and Munich.

- Its principal focus lies on small satellites and satellite data applications

- Challenges for NewSpace in Germany are funding and an excess of bureaucracy

- Steps have been undertaken on a public and private level to reduce those challenges

What is the state of the German NewSpace economy in early 2020? Apparently the future looks bright: investors as well as companies and entrepreneurs have reason to believe that the current decade will see a surge in the NewSpace economy. Both the size of the German NewSpace sector in number of companies and people employed can be expected to keep growing as can the output of the German NewSpace economy on the national and international market. With growing demands and applications for satellite data it can be anticipated that Germany as a high-tech country will invest in this market giving the NewSpace sector opportunity to grow. The interrelated upstream industries like hardware products and launch services will undoubtedly profit from the downstream boom earth observation and communication currently provides. Germany’s GDP will also be fueled by the growth in new space, since downstream services are popular and in demand around the globe. Both developed as well as emerging economies request more and more satellite data applications, making the new space industry a possibly strong exporter of German goods and services for the future.

To understand the positive outlook for the German NewSpace industry its state, challenges and opportunities will be outlined below.

Where is the German NewSpace industry situated?

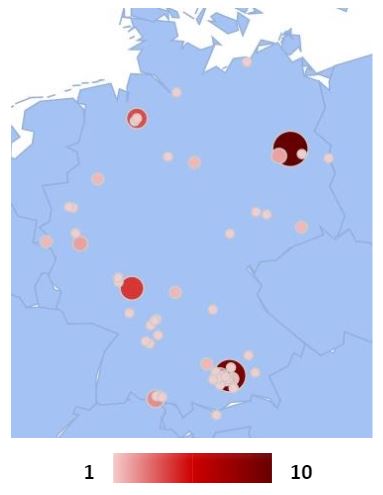

Map 1. Number of space startups, scaleups and corporates per city.

To answer this question NewSpaceVision aggregated data of all the german space startups, scaleups and corporates. As can be seen on the resulting map 1 the German space industry is mostly concentrated around four centers: Bremen, Darmstadt, Munich, and Berlin. Whilst the space economies in Darmstadt and Munich grew around the Business Incubation Centers of Darmstadt and Oberpfaffenhofen and the established industry players such as the DLR and Airbus, Bremens industry grew, until recently, without the support of an ESA BiC (Business Incubation Centre), but was kickstarted by its proximity to OHB. With the launch of ESA BIC North in 2019 Bremen now also benefits from ESAs support for Startups. The fourth center, Berlin’s space economy, however, is up to date unsupported by the presence of an incubation center or a major company.

It emerged on its own and is mostly based in the NewSpace industry with its main focus on the launch and manufacturing of small satellites as well as satellite data applications. A reason for this emergence may lie in some favorable features of the dominating Startup environment in Berlin that make it a center of the NewSpace industry in Germany. Daniel Seidel already wrote an article on this topic for NewSpaceVision which analyzes Berlin’s ecosystem in more detail: 10 reasons why Berlin will be the center for NewSpace in Germany which can be found here. In order to give startups in the thriving business location Berlin a better chance and make them more competitive with their counterparts located close to ESA BICs and big industry players, NewSpaceVision recently created a private incubation initiative.

What is happening in the NewSpace sector?

| Figure 1. Number of existing Space companies founded/year in Germany |

From figure 1 it can be derived that Germany’s NewSpace economy has been growing over the past two decades with 2018 being a record year for NewSpace startups founded. This trend started around 1995 and can be expected to continue with more and more space applications and industries emerging. The main focus of Germany’s NewSpace sector currently lies within the creation and application of satellite data. This is also reflected in the kind of companies founded over the last three years. For an overview of the NewSpace sector in 2017 and before the article The NewSpace Sector in Germany / Status of the German New Space Economy, by Sven Przywarra can be recommended. Many of the startups founded since 2017 offer satellite data application services: ConstellR, OroraTech, Deep Blue Globe, LiveEO, and KLEO for satellite communication. Next to data application the industry of commercial satellite manufacturers is also growing with Smart Small Satellite Systems and iBoss. A third industry related to satellites is launch services and rocket manufacturing/hardware. Newly arisen players in this branch are: Isar Aerospace, Levity Space Systems, Rocket Factory Augsburg, Back Engine Aerospace, HyImpulse Technologies, and Morpheus Space. Finally there are niche sectors in which innovative German entrepreneurs are venturing: Yuri is offering services related to microgravity, Orbital Recycling is looking into reducing debris while recycling its material, while Space origami is experimenting with growing DNA origami crystals in microgravity. Bake in Space is developing crum free bread for the ISS, and Astronautin want to advance research by bringing female astronauts into space. Next to the emergence of new startups the market is also growing in the amount of capital circulating. The most impressive example of this over the past three years was Mynaric going pubic which generated an initial amount of 27.3 million Euro in 2017. Up to date they hold a market cap of over 125 million Euro. This heightened the hopes of further NewSpace companies significantly which may also be able to generate money through public shares since a demand for NewSpace seems to exist on the German stock market.

How does the German NewSpace Industry stand internationally?

Internationally the German New Space sector is a bit behind in funding but this may just be balanced out by the great opportunities the international space market holds for German companies. Currently there is little funding for early-stage companies and startups from individuals or venture capital companies in Germany. Contrary to the U.S. where billionaires like Jeff Bezos direct their money into the New Space sector creating a lot of publicity and encouraging further venture capital to flow into emerging businesses. Furthermore large amounts of the U.S. Space budget flow into the private sector where even a startup like “made in space” was able to score a 73.7 million Dollar contract with NASA. In Germany it is a lot harder, if not nearly impossible, to acquire government contracts for startups and early stage companies compared to the U.S. since proof of past and future success and existence is often key in the application process. This makes it inevitable that most or all of the state contracts for DLR and ESA go to the biggest, most established players in the Germany space industry like OHB. It also creates a huge hurdle for startups that cannot access the lucrative public-private market and are therefore confined to the private space industry alone. A further problem in funding is that in order to be supported by U.S. donors it is often required of European companies to move their headquarters into the U.S. making them an object of U.S. regulations and taxation. Hence it is indispensable for the German space economy to build up a financial environment that encourages entrepreneurs to create and maintain their businesses within Germany. Moreover, bureaucracy can also be a hurdle for the NewSpace economy since it can take up vast amounts of time and resources to write proposals. This can make it very expensive to utilize local resources instead of for example buying payload from external sources. Nevertheless, Germany as a business location has a lot to offer: it is known for the skill and expertise of its engineers, there are world class universities and research centers dedicated to aerospace technology and sciences and finally it enables easy access to the international market. As part of the European Union Germany is already embedded in a unionized multinational market. Additionally and contrary to the U.S., the rules and regulations concerning technology transfer in the space industry are less strict. This enables a far reaching access of German companies to the world market that oftentimes is denied to their U.S. counterparts. In this competitive advantage the biggest opportunity for German and European space businesses can be found.

What steps are undertaken to overcome the challenges in the NewSpace sector during the 2020s?

In conclusion, finance and bureaucracy are currently the biggest challenges of the German NewSpace industry. In exchange the opportunities for this sector to become a major exporter of goods and services globally are equally good. Encouragingly the last ministerial council meeting of ESA also bore good news for supporters of the NewSpace sector: 14.5 billion Euro will be invested in the European Aerospace sector over the next couple of years. With the largest sum of 3.3 billion Euro contributed by Germany which also represents its willingness to invest in the space sector. Therefore, there is reason to believe that some of the financial problems of startups and early stage companies will be alleviated by an increasing amount of private-public contracts as well as financial support by ESA. This positive outcome may well be attributed to an increasing awareness of the importance of the NewSpace sector on the ministerial level. Responsible for the increasing political attention in Germany and the positive outcome of the ESA ministerial council meeting are some key actors like Thomas Jarzombek, aerospace coordinator for the Federal Republic of Germany, and Matthias Wachter from the Federation of German Industries (BDI) which are dedicated to support the German NewSpace sector. In the future it will be important to maintain this political interest as it is closely linked to financial resources and industry rules and regulations that could either benefit or hamper the NewSpace sector. Furthermore a continuously high demand for services and products from government agencies as well as their resulting cash flow and investments into the NewSpace sector will provide for a stable financial environment that attracts investments from the private economy into NewSpace as well.

Next to political interest the interest of private venture capitalists and venture capital companies in the German NewSpace sector also seems to be on the rise. Downstream companies such as LiveEO are showing that there is an emerging interest of VCs to invest into early stage space analytics companies. Compared to those, hardware companies in the space sector have traditionally struggled in creating the same amount of interest from VCs. Nevertheless, there are also positive signs in the hardware domain for Germany’s space Startups. For example Isar Aerospace was able to close a 17 million Dollar Series A investment round led by Earlybird and Airbus Ventures in late 2019. For a German rocket company to raise this amount of money in a Series A financing round would have been unthinkable just years ago. But now these companies are creating role models for future New Space Businesses in Germany proofing it is possible to generate venture capital for the NewSpace sector and providing examples on how this may be done. This trend of an increasing amount of Venture capital in the space sector can also be seen internationally: the Sepharim Space Index showed an increase of venture investment in the space sector of 21% globally last year; amounting to a total of 4.1 billion Dollar in 2019. 13% of these investments, 533 million Dollar, flowed into the European economy alone. For more information visit their website.

With its incubator NewSpaceVision offers a third way of funding and support: A private incubation program. Not venture capital is invested in this approach but startups are thoroughly supported through the critical phase of their market entry. This has been done with the ESA BICs before but through the example of the NewSpaceVision incubator a market for private incubation initiatives may develop as well. This would lead to a further increase in the amount of funding and support available to space startups in Germany.

What do these developments mean for the German NewSpace sector?

With the upcoming wider opportunities of funding the growth of the NewSpace industry in Germany can be expected to continue and most likely also to accelerate over the current decade. This will make the 20s the most successful decade for new space so far and will probably lead to a vast commercialisation of the space industry. Especially in the mid tier growth can be expected when former startups establish themselves on the market, supported by private and public funding, and take over a chunk of the contracts that were formerly distributed between the giants of the industry.

No responses yet